It’s Sunday, November 10th, 2024, and in this week’s roundup, learn in 5 minutes or less:

Career Advice: If $100k a Year is Still a Good Salary? Let’s take a look at the numbers

Money Moves: Is Cryptocurrency an option for your money or should you focus your strategy on classic investment options like Index Funds, ETFs & Bonds

Think Wellness: Walking for fat Loss over-running and why getting up and going into office helps you lose more weight compared to wfh life

Mindset Matters: An abdundance mindset to achieve your goals

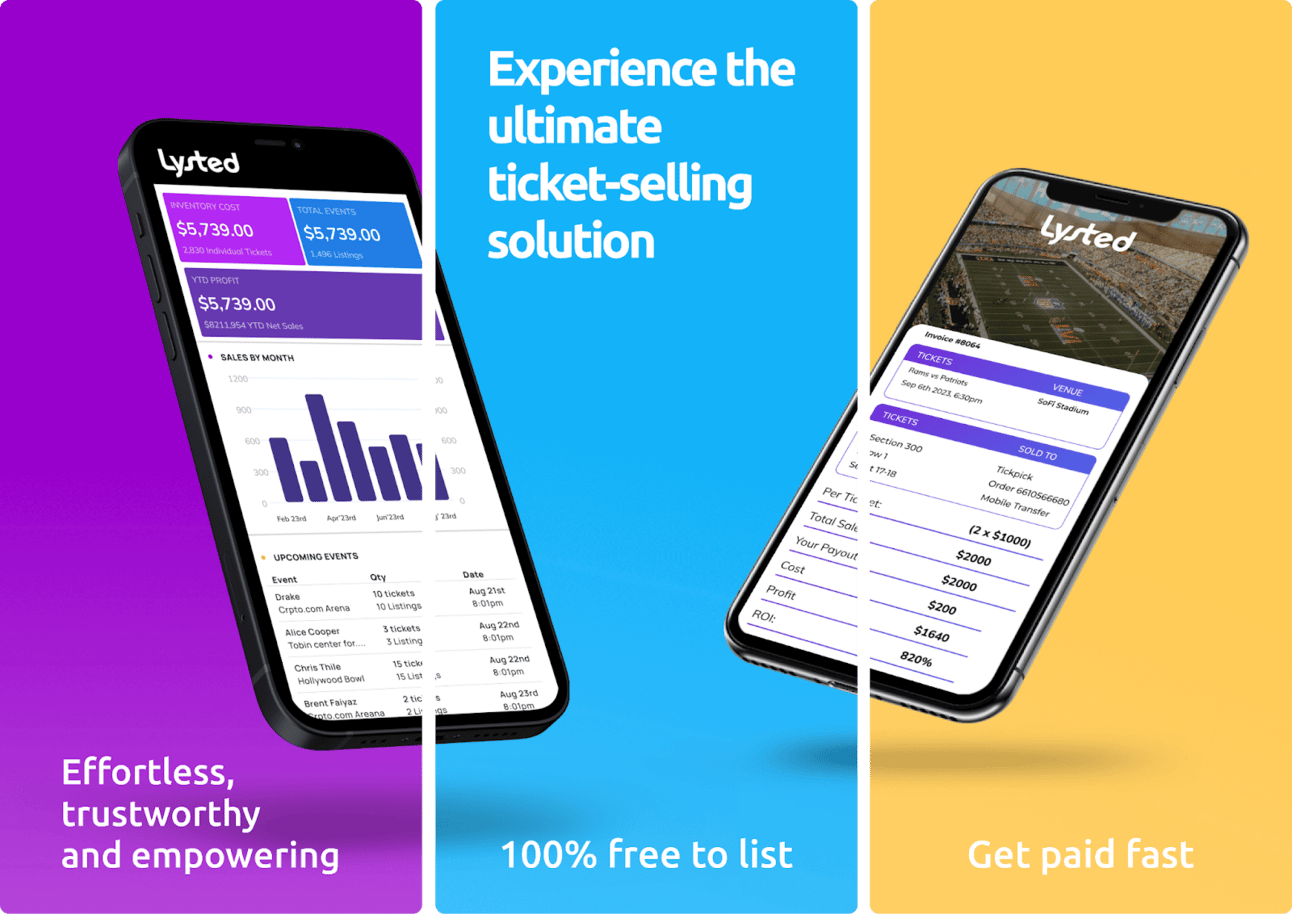

Make Extra Cash Reselling Tickets with Lysted

Looking for a new side hustle to boost your income? Don't let unused concert tickets go to waste—turn them into cash with Lysted!

Lysted's advanced pricing tools ensure you get top dollar for your tickets, making it easy to maximize your profits. With just one listing, your tickets are available on major platforms like StubHub, Ticketmaster, and Seat Geek, saving you the hassle of managing multiple listings.

Plus, Lysted offers fast payouts, getting your earnings directly into your bank account within weeks. It’s a smart and simple way to make extra cash on the side.

CAREER ADVICE

Is $100k a Year Still a Good Salary?

Happy Sunday Team,

Once considered a hallmark of financial success, $100k a year doesn’t stretch as far as it used to. With inflation rising and the cost of living increasing across the globe, it’s essential to evaluate if this salary still aligns with your lifestyle goals.

Here’s a breakdown:

Housing: In many urban areas, housing eats up 30-40% of a $100k salary.

Taxes: Depending on your location, income taxes could shave off 20-30%.

Essentials: Groceries, utilities, and transportation costs continue to climb.

While $100k remains a solid income for many, building wealth often requires smart financial planning. Consider strategies like side hustles, investing, and budgeting to maximize your earnings. Remember: it’s not just about how much you make—it’s about how much you keep and grow.

What amount should we be striving for now?

How much income for a family of 2 with 2 kids in 2024? Location and lifestyle matter. Studies show costs vary widely but raising a family in many urban and suburban areas now requires over $100,000.

For example in cities like London, New York or San Francisco the cost of living can push the necessary household income over $150,000 due to high housing, childcare and transportation costs. In smaller cities or rural areas it can be around $70,000-$80,000 to live comfortably according to the Living Wage Calculator.

Here are examples from real life…

One tech consultant in Birmingham with a $120,000 salary says it’s “barely enough” after mortgage, daycare and healthcare.

A family in rural Ohio, USA with an $85,000 household income says it’s “adequate but tight” and can cover essentials but not emergencies or retirement.

Millennials and Gen Z wanting to support a family of 4 should consider their target location and career progression and ideally aim for dual-income households where possible.

Working in high-demand fields like tech, healthcare or finance can also boost income prospects SMARTASSET SMARTASSET ECONOMIC POLICY INSTITUTE

Stay tuned for more career tips and insights next week. In the meantime, keep leveling up! 🚀

SUNDAY MOTIVATION

All our dreams can come true, if we have the courage to pursue them

Money Moves

Cryptocurrency vs. Classic Investment Options?

Should you jump into crypto or stick with traditional investments? Here’s a balanced view:

Cryptocurrency: High-risk, high-reward. Bitcoin and Ethereum have shown massive returns but are volatile. Great for short-term risk-takers or those looking to diversify.

Index Funds & ETFs: Lower risk, consistent growth over the long term. They track market performance, making them ideal for retirement or building wealth steadily.

Bonds: The most stable, offering fixed returns, but growth is slower.

Bitcoin (BTCUSD), though volatile, has outstripped the returns of the S&P 500 since the beginning of September. The largest cryptocurrency has benefited from investor optimism driven by the Federal Reserve's rate cuts and the U.S. presidential elections, among other factors.

Verdict: A mix often works best. Use crypto for calculated risk, but ground your strategy in reliable options like index funds and ETFs. Ensure you have an emergency fund and other financial safeguards in place before diving into high-risk assets.

Think Wellness

Think Wellness: Why Walking (and Going to the Office) Might Help You Lose Weight

If you’re trying to choose between running and walking for fat loss, you might be surprised: walking often wins. Low-impact but highly effective, walking is sustainable and helps regulate hormones like cortisol, which can influence fat retention.

And here’s an unexpected twist: commuting to the office might actually boost your weight-loss goals. How?

More Movement: Walking to and from the office or even between meetings keeps you active.

Burns More Calories: Office environments require physical activity that WFH setups often lack.

Mental Health: Changing environments reduces stress, which can indirectly support weight management.

The key is consistency. Aim for at least 7,000-10,000 steps daily and incorporate more standing or walking into your routine.

Mindset Matters

Mindset Matters: Abundance Over Scarcity

An abundance mindset can be your secret weapon for achieving your goals. It’s the belief that there’s always enough success, opportunity, and resources for everyone—removing the need for competition or fear.

How to cultivate this mindset:

Reframe Challenges: See obstacles as opportunities to learn and grow.

Celebrate Others’ Wins: Their success doesn’t diminish yours.

Visualize Your Goals: Focus on what you can achieve, not what you lack.

Practice Gratitude: Reminding yourself of what you have opens doors for more.

When you adopt an abundance mindset, you stop holding yourself back and start taking bolder steps toward your aspirations.

Latest on Instagram

I Don’t Know Who Needs To See This. Maybe this is your sign to consider a career in Project Management ?

Latest on TikTok

@resumeofficial Down with happy hours please #corporateevents #workhappyhour #worklifebalance #genzatwork #genzworkplace #millennial #sidehustle #work

OUR RESOURCES

Career Growth Bundle Pack & Personalised Resume Review: Download the bundle to get everything you need to achieve your career goals.

Personal Finance & Wealth Builders Bundle Package: Supercharge your finances with a suite of tools.

STUFF WE ARE LOVING RIGHT NOW

Interactive Investor is a UK-based investment platform and a perfect investment platform. It is a low-cost, award-winning, online investment platform enabling you to invest in stocks easily and manage shares, funds, SIPPs, ISAs & more.

Course Careers is ideal for someone trying to get into a career with Tech and start for FREE.

Skillshare is perfect for those keen on learning a new skill and for continual learning in the creator economy. Anyone can take an online class, watch video lessons, create projects, and even teach a class themselves on topics ranging from videography to Facebook ads and growing a personal brand on TikTok.

Passionate Income Newsletter: Empower your mind and gain financial literacy. Learn, improve, and grow. Actionable steps in a bite-sized three-minute read. Join for free.

Talk to us…

You made it to the end of our newsletter!

So, spill the beans… What’s your number 1 pain point right now?

Is it about not getting paid enough/difficult colleagues/a toxic boss/wanting to start a new role/pivoting into a new industry/work-life balance/ time management/low self-esteem & confidence/ wanting a side hustle/other?

Reply directly to this email and let us know! 📧

What did you think of today's edition?

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational content and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions.

Want to advertise with us? Apply here